BWA Insolvency

Quarterly Market Report: Q2 2025

Signs of stabilisation in NZ insolvency market: Q2 2025 insights

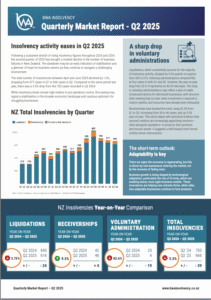

After two years of rising insolvency activity, Q2 2025 has delivered a modest but notable shift: a 1.6% quarter-on-quarter decline in total insolvencies, from 677 in Q1 to 666. Compared to the same period last year, this represents a 5.5% drop and potentially signalling the early stages of market stabilisation.

While insolvency levels remain elevated relative to pre-pandemic norms, this easing may offer cautious optimism for business owners navigating a still-challenging environment. However, the data revealed in the Q2 2025 BWA Quarterly Market Report paints a more complex picture beneath the surface.

Receiverships on the rise, Voluntary Administrations plummet

Liquidations, which make up the bulk of insolvency activity, fell 3.6% from Q1 to Q2. Voluntary administrations remained flat at four cases but dropped dramatically year-on-year—from 23 to just four, an 82.6% decrease. This sharp fall may reflect a lack of viable turnaround options, with many businesses seeking help too late to recover.

In contrast, receiverships rose 35.3% quarter-on-quarter and 9.5% year-on-year. This increase suggests a growing trend of creditor-driven interventions, with secured creditors more frequently appointing receivers—often alongside liquidators—to protect their positions and recover assets.

Sector Trends: Construction leads, Retail and F&B Struggle

Construction continues to dominate insolvency enquiries, with a year-on-year increase of 22 cases. Consumer confidence in property developers remains fragile, exacerbated by high-profile failures and uncertainty around whether cost savings from new building supply policies will be passed on.

Conversely, the property and real estate sector saw a 34% year-on-year improvement. Agriculture, transport, and delivery also showed signs of recovery. However, the food and beverage and retail sectors experienced significant increases in insolvencies—24% and 33%, respectively—highlighting ongoing pressure in consumer-facing industries.

Looking Ahead: Adaptability will define success

The short-term outlook suggests that while the economy is regenerating, growth is being driven by new, tech-savvy entrants rather than the recovery of legacy businesses. The rise of AI and leaner business models is enabling more agile operations, leaving less adaptable firms behind.

As we head into the latter half of the year, increased consumer spending and easing financial conditions may offer some relief. But with the IRD maintaining a firm stance on compliance, financially vulnerable businesses remain at risk.

Read the full Quarterly Market Report for Q2 2025 here.