BWA Insolvency

Quarterly Market Report: Q1 2024

Each quarter we report on the latest NZ insolvency data and provide insight and analysis on the stats. Unsurprisingly, the latest Quarterly Market Report for Jan – Mar 2024 shows a steady increase in insolvencies.

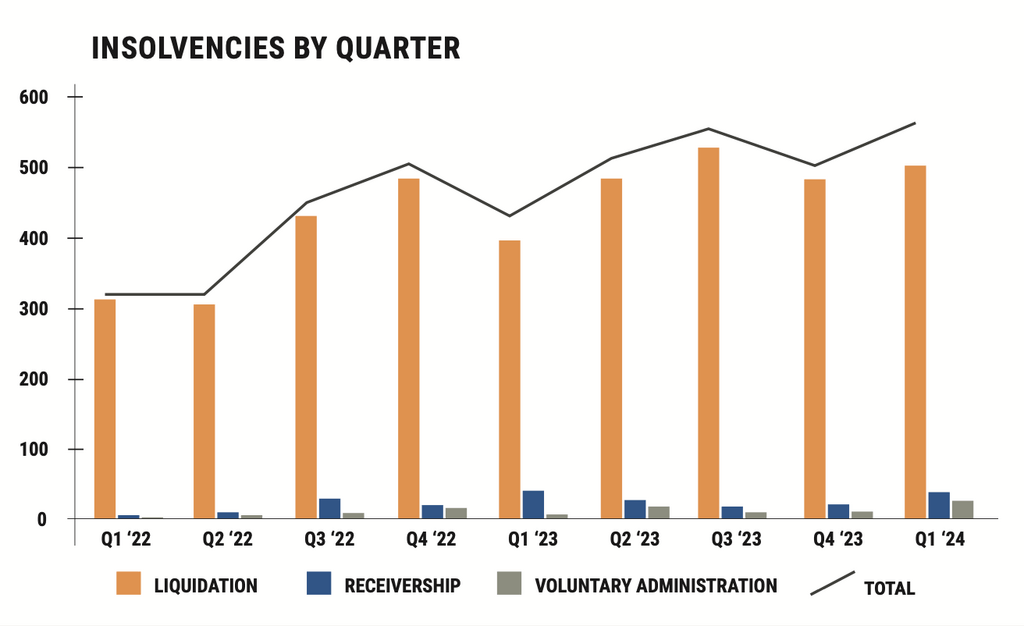

There has been a 10% increase in insolvencies compared to last quarter, up from 501 to 553, and a 28% increase from this time last year, where we saw a total of 432 insolvencies.

The most significant shift is from Voluntary Administrations (VAs), which has seen a 317% increase since last year, up to 25 from 6. This can be interpreted as good news, as it means more insolvency practitioners are being approached by directors in positions where the business has a possibility of being saved, and it is allowing them to explore all options, without having to immediately liquidate.

Receiverships have also increased, with an additional 20 receiverships since last quarter.

While a 28% increase seems significant, if we compare to Quarter Three of 2023, it is only a 2% increase in insolvencies. There is no doubt that there is a steady incline of insolvencies in recent years, but it is important to look at the overall picture, and not jump to drastic conclusions when looking at insolvency data. Given the current inflation rate, and the caution of consumer spending, we expect to see this steady increase to continue into Quarter two.

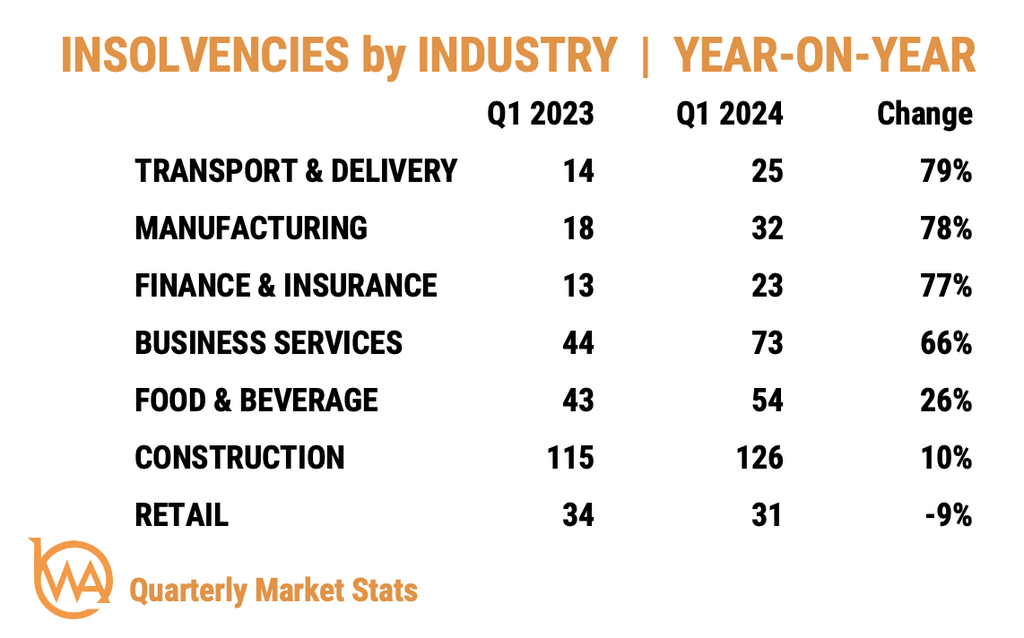

The short-term outlook for many sectors—retail and construction in particular—is grim. The current government is taking the view that the bitter pill must be swallowed and while this, in a macro sense is sound, it will cost many businesses. The sky is not going to fall in, but it is going to get chilly.

Industry Spotlight:

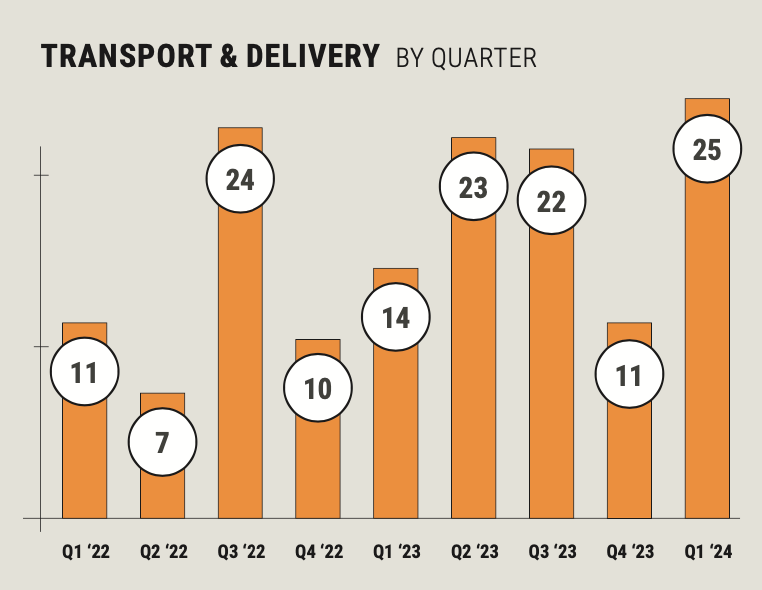

Challenges facing the Transport & Delivery sector

There has been a 136% increase in insolvencies in the transport and delivery industry, up to 26 insolvencies, compared to 11 in Q4 2023 and 14 in Q1 2023.

A shrinking economy will inevitably affect service providers. A drop in consumer spending converts into a drop in the need for shifting of goods. A busy transport company will begin to have idle time, where profit is not being made but overheads will continue to be charged. Add into the mix an increase in interest rates on serviceable debt, and it is clear to see why companies are facing insolvency.

The BWA Insolvency Quarterly Market Report. BWA Insolvency has been tracking the data on liquidations, receiverships and voluntary administrations since 2012. The Registrar of Companies Office records the filings of companies that have gone into a formal state of insolvency. BWA then does a deeper investigation into each company and categorises them to show trends across different industries and regions.