BWA Insolvency

Quarterly Market Report: Q4 2025

Insolvencies hit highest annual level since the GFC

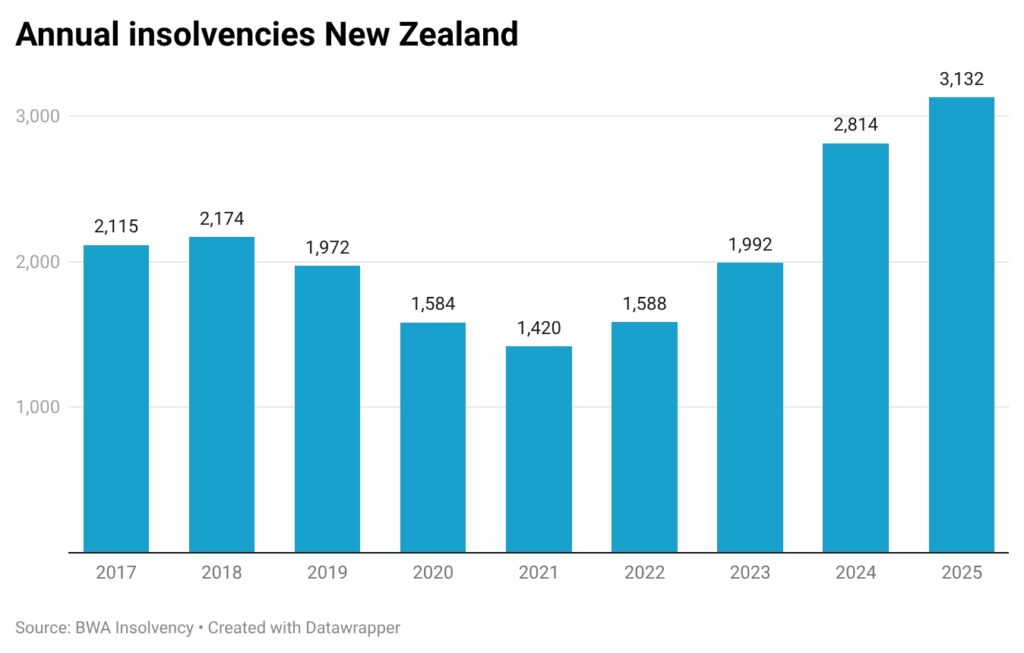

New Zealand experienced its highest level of business insolvencies since the Global Financial Crisis in 2025, according to new data from BWA Insolvency.

The BWA Insolvency Quarterly Market Report confirms 3,132 liquidations, receiverships and voluntary administrations were recorded in 2025, an 11.3 per cent increase on 2024 and the highest annual total in 15 years*.

BWA Insolvency principal Bryan Williams said the sharp rise in failures reflects pressures that have built over several years and are now coming to the surface.

The final quarter of 2025 saw a significant increase in appointments, reaching 933 cases. This was a 31.5 per cent increase on the same quarter in 2024 and the strongest quarterly rise of the year.

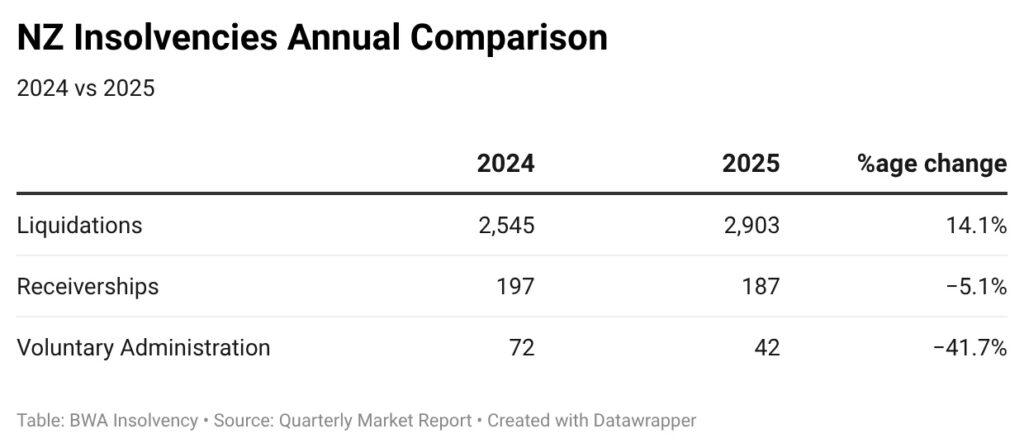

Liquidations increased from 666 to 891 during the quarter while voluntary administrations rose from 6 to 16. Receiverships decreased from 37 to 26.

Williams said the latest business confidence results show genuine signs of improvement in economic sentiment, yet they co-exist with persistent financial strain for many companies.

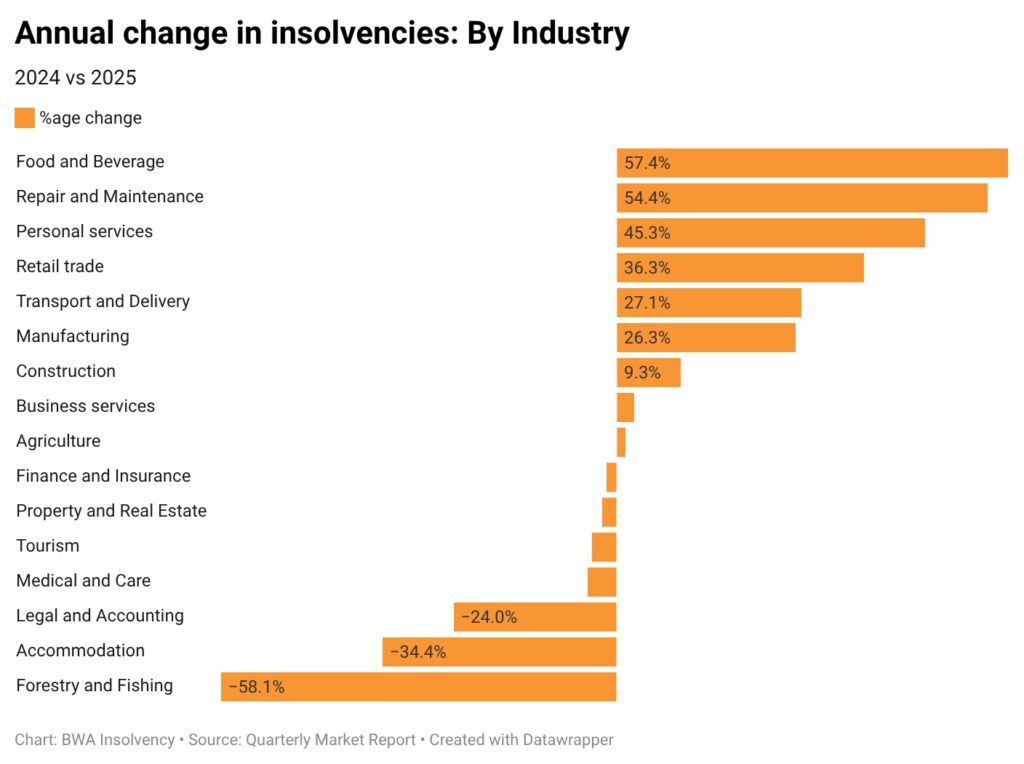

While construction had the highest number of insolvencies in 2025, the rate of new insolvencies in the sector is slowing, with a 9.3 per cent year-on-year—much less than the sharp increases seen in previous years. This suggests the worst pressures may be easing for the industry.

Several consumer-facing and cost-sensitive sectors saw substantial increases. These included food and beverage, repair and maintenance, personal services, retail trade, transport and delivery, and manufacturing.

Williams said the large number of closures is unlikely to hinder the broader recovery that many forecasters expect to continue through 2026.

“These closures reflect the challenges of recent years, not the conditions we are moving into. Their only connection to today’s economy is that they continue operating within it, without the financial strength to survive,” he said.

The full Quarterly Market Report is available here.

*Centrix Credit Indicator Report tracks company liquidations from 2005. Centrix January report is here.