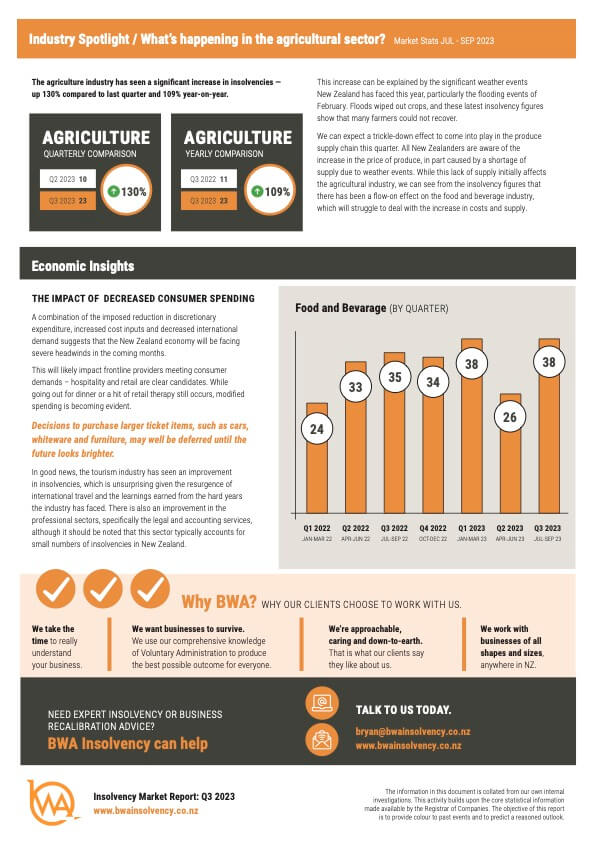

Insolvency in New Zealand Quarterly Market Report – Sep 2023

BWA’s Quarterly Market Update on NZ voluntary administrations, liquidations, and receiverships across New Zealand and by industry is out for Q2 2023.

MEDIA RELEASE FROM BWA INSOLVENCY, AUCKLAND. 3 November 2023.

Second wave of business insolvencies ahead

A leading insolvency firm warns that a potential second wave of business failures is on the way, with consumer-facing sectors in the firing line.

BWA Insolvency managing director Bryan Williams says the continuing pressures of reduced consumer spending and slowing global economies are impacting NZ businesses, as detailed in the latest BWA Insolvency Quarterly Market Report.

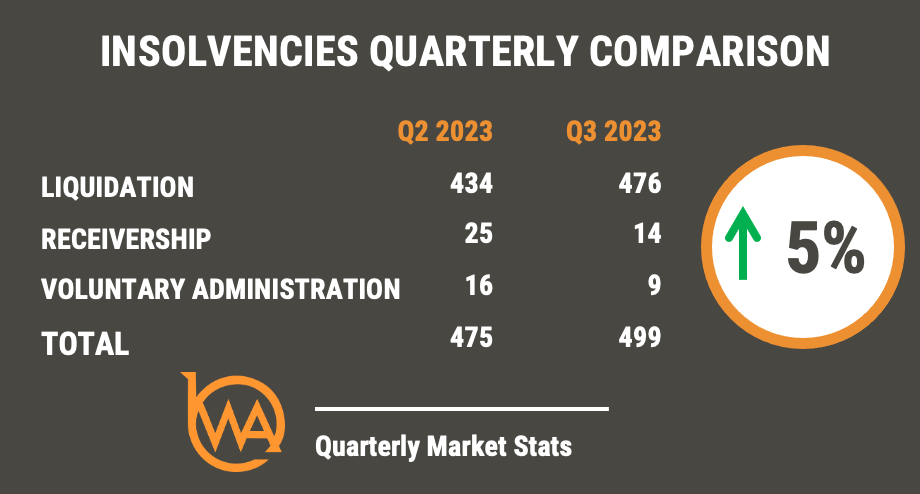

Business insolvencies in New Zealand were up 20% for Q3 (July 1-September 30), compared with the same period last year. However, the Q3 results were only up by 5% on Q2 2023.

Williams cautions that the slowdown in insolvencies does not necessarily indicate a positive trend.

“This quarter has seen a levelling of insolvencies with only a small increase over the previous quarter – this is due to the fact that the pool of insolvent companies that were impacted by the pandemic have either recovered or ended their life,” he says. “But there is a second wave on the way. A reduction in consumer spending is enough to cause vulnerable companies to become terminal but add to that a slow wind-down of all major economies and it’s a safe bet that many companies will confront an existence-threatening event in the coming months.”

“As liquidity tightens due to the Reserve Bank’s anti-inflationary measures, we can expect sectors that directly face the consumer to bear the brunt of the tide going out. The combination of the imposed reduction of discretionary expenditure, increased cost inputs and decreased international demand suggest the NZ economy will face severe headwinds in the coming months.”

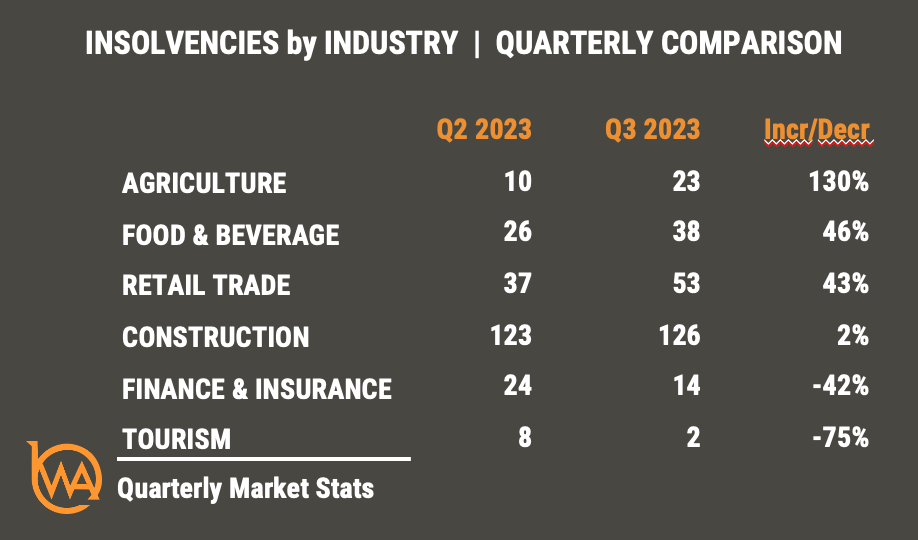

There has been a sharp increase in insolvencies within the food and beverage, retail, and agriculture sectors, up 46%, 43% and 130% respectively from the last quarter.

“Hospitality is a clear candidate,” says Williams. “While we may still go out for dinner, modified spending patterns will be evident. Trades too will be impacted as customers defer renovations or construction work to a later date. Larger-ticket items such as cars, whiteware and furniture may be delayed to a time when the future looks a little brighter.”

In Q3 2022, there were 28 insolvencies in the retail sector. In the same period this year, there were 53 (an increase of 89%). Insolvencies in the food and beverage sector have only increased marginally when compared to 12 months ago, however compared with Q2 2023, insolvencies have jumped from 26 to 38.

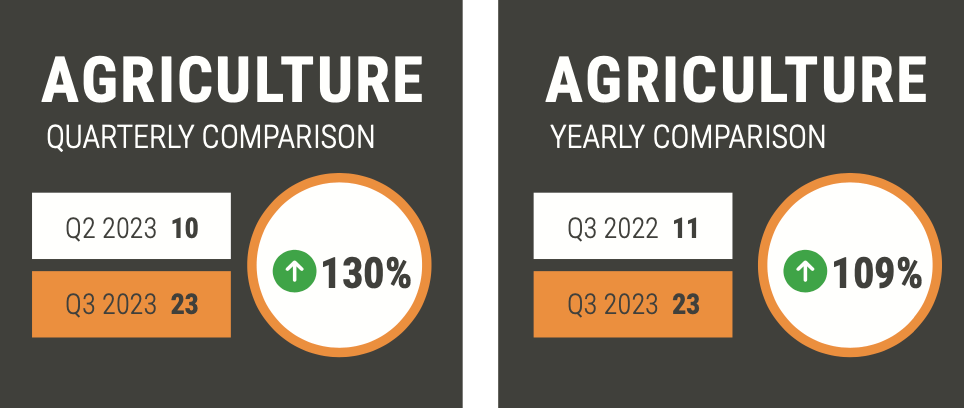

The agriculture sector has experienced a significant upswing in insolvencies in the third quarter of 2023, up by 130% compared to the previous quarter and 109% compared to the same period last year. Williams says lower international demand showing up in prices, severe weather events and flooding earlier in the year have rendered many farmers unable to recover financially.

“A trickle-down effect has been observed in the produce supply chain this quarter, which has led to a shortage in supply and an increase in the cost of produce.”

Another industry expected to feel the impact of the coming wave is construction.

“Australia has recently seen many large building companies collapse, citing increased cost and labour shortages as the reason for failure. The reality is that this is not the root cause but rather the factor that tipped them over. Companies fail because they are not able to overcome the dangers they face. Directors cannot see around corners, but they are able to provide for the unexpected at some reasonable level and this often does not occur.”

Williams believes it is “likely” that New Zealand will see a similar trend.

“Cranes are leaving skylines in major cities, and building permits keep going down month on month. Add to this the growing cost of labour and materials, and it seems clear that headwinds for that industry are on the way.

In good news, the tourism industry has seen a slowing in insolvencies, which Williams believes is “unsurprising given the resurgence of international travel and the learnings earned from the hard years the industry has faced”.

BWA Insolvency’s Quarterly Market Report provides a snapshot of the NZ market by tracking data on liquidations, receiverships and voluntary administrations. Data is obtained via the Companies Office, which tracks the filings of companies that have entered a formal state of insolvency. BWA then categorises each company to show trends across different industries.

BWA’s next quarterly report will be published in January 2024.