BWA Insolvency

Quarterly Market Report: Q4 2024

New Zealand insolvency numbers hit nine-year high.

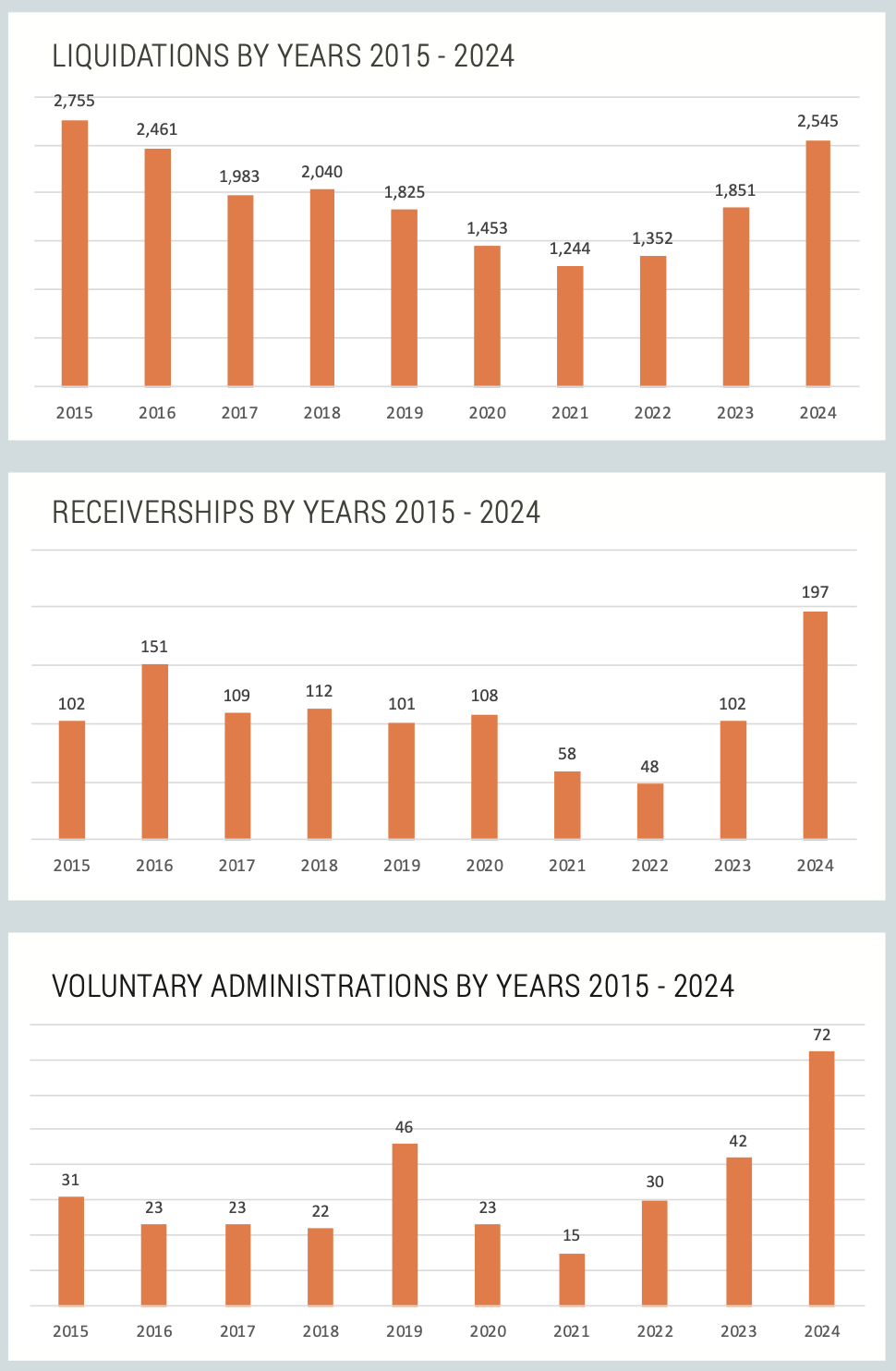

According to the latest BWA Insolvency Quarterly Market Report for Q4 2024, New Zealand’s annual insolvency figures have reached a nine-year high, matching levels not seen since 2015. The report highlights a dramatic surge in business failures throughout 2024, with liquidations more than doubling from their 2021 low of 1,244 to 2,545 cases in 2024.

Receiverships and voluntary administrations (VAs) also saw increases, recording 195 and 72 cases respectively. The VA pathway, featured in high-profile cases like Ruapehu Alpine Lifts, Ezibuy, and Cannasouth, has more than doubled over the past nine years and is nearly five times higher than its lowest point in 2019, suggesting a growing preference for this option when businesses show potential viability.

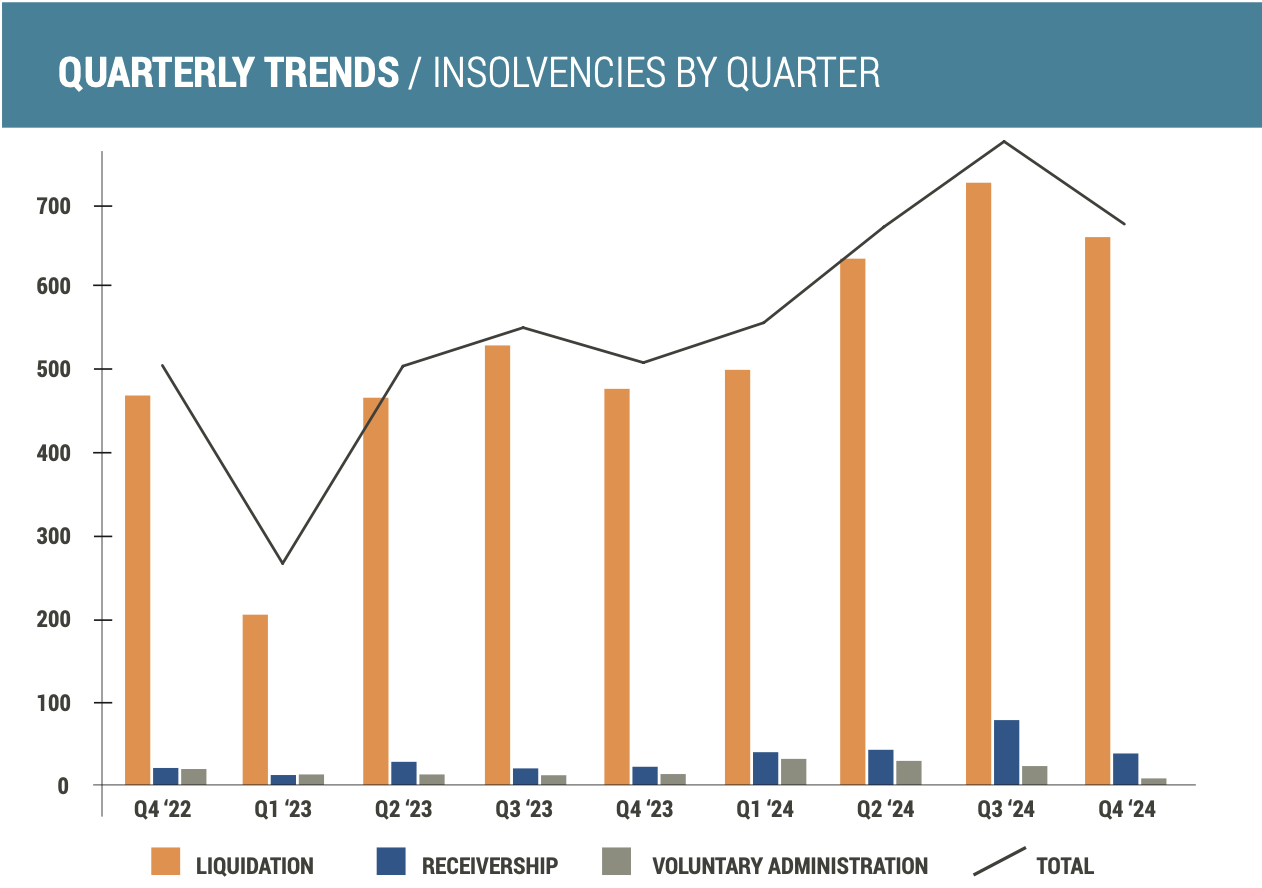

While Q4 2024 brought the typical seasonal dip in insolvencies as retail and hospitality businesses pursued crucial Christmas revenue, year-on-year quarterly insolvencies still rose by 39%. Compared to Q4 2023, liquidations jumped by 41% and receiverships by 85%, though voluntary administrations declined by 40%.

The construction industry has been particularly hard-hit, with insolvencies skyrocketing from 273 in 2020 to 717 in 2024—the highest in a decade. Developers who purchased land at peak 2021 prices now struggle with profitability amid rising supply costs and a cooling housing market, creating a domino effect impacting smaller contractors.

Other sectors showing significant increases include Property and Real Estate (168 to 307), Retail Trade (reaching 638), and Business Services (173 to 290). The Food and Beverage industry also rose from 170 insolvencies in 2020 to 235 in 2024.

The report attributes these trends to several factors: many businesses failed to recover from pandemic-altered consumer spending habits, particularly the shift to online shopping. Combined with recession fears and higher interest rates, 2024 proved that determination alone cannot guarantee business survival in challenging market conditions.