Seeing The Light In A Failed Business Rescue Plan

When the waves keep coming, the only way to overcome their weight and turbulence is to learn how to surf. Insolvency is very much like the breaking surf, bringing noise, confusion and murkiness as claims from creditors emerge and start to close in on the business. Directors will often meet this stressful circumstance with ploy and shrewdness thinking that survival is best achieved by avoiding the very issues that should be confronted head on.

Learning to surf the dynamics of a failing business is likely to be new to the owner. Insolvency is not something encountered frequently enough for the directors to become skilled in this field. Nor is failure dwelled upon when starting out and will be the last thing that is thought of when striving to succeed in the business. The dynamics of insolvency will be a new encounter for the directors and potentially a painful one as the circumstances take on a personal slant.

The effect of insolvency is not confined to the company – both the turbulence, and the economic consequence, hits both the company and its creditors. The other side may present acrimoniously because someone else’s shortcomings have caused damage to them. Here is an important point though – the business in trouble may be failing and that means that management has failed but it does not mean that management is a failure!

To avoid that failure label, directors must conduct their business affairs in a different way than has occurred up to this point. It is highly likely after all, that it is the failing of management that is the probable cause of the condition. To have any credibility, the change in approach must demonstrate that the company’s creditors are at the heart of its future activity.

It is all very well to have such a plan, but unless there are avenues for its implementation it will not see the light of day. Intention is one thing but being able to perform is quite another. The solution to be found is how management makes such a momentous shift in its approach and have that accepted by the creditors. The reality is that there is no model answer for this situation. In this swirl of activity, the directors will need to find a way of convincing creditors that their plan for survival is better than the creditors taking action themselves. This will require the directors to submit a plan born out of one eye on the past to ensure mistakes are not repeated, and the other on the future that shows modest and credible results. The important thing is that the company is not dead yet and until it is, there is potential for its revival – the alternative is that the company becomes just another statistic.

Undying commitment for survival by itself will not be sufficient though. There must be commitment in abundance but without staircasing through some tangible objectives, commitment alone will fail for the want of achieving benchmark outcomes. Solid stepping stones need to be found so that trust and confidence can be rebuilt, and rehabilitation can become a reality.

Firstly – get to know exactly where you are in the woods. Business is about wealth creation and this is measured in money terms. Ask for assistance to prepare a statement of position – it should not take more than an hour using your assessment of value. Estimations are near enough at this stage – you just want to know roughly your whereabouts so that you can prepare a course of action showing the way out.

Secondly, define what value your business can provide. Why should customers come to you and how valuable is the good or service to them. Success in business is not a right of existence, it is a consequence of the value that is transferred to customers that are willing to engage with the business. Pulling the business out of a hole, in the long term, is about making sustainable profits from providing value. If there is no value to provide, or the costs of providing it are greater than the profit to be earned, then perhaps there is not a business to save.

Thirdly, honestly describe what has gone wrong. Get down to the nitty gritty of the matter and answer up against the issues. There is one common element that is critical to comprehend and factor into the analysis – management did not see the insolvency outcome or did not respond to it in a way to defeat it when it became apparent. Management should not engage in some self-effacing introspection and retort that they are to blame for everything that lives and breathes in the organisation – rather, management needs to understand what other decisions might have been made so that the outcome being confronted now, might have been different. Nothing that has happened can be changed, but if the cause of it is understood it is less likely to be repeated.

Fourthly, it is imperative that management plans its activity. Plans themselves are nothing but the process of planning is everything. The completion of an excel workbook full of numbers and formulas may look impressive but unless those numbers accurately represent an actual occurrence in the business, they are just numbers on the page. Plan honestly and diligently – do not be fooled by the promises of bells and whistles programs, the answers are not in IT functionality but in the thinking persons’ head that is seriously concerned about the survival of the business. Plan the future with intuition and foresight by developing a big picture view made up of moderate action steps, and then implement the plan with confidence.

Fifthly and lastly, get help. The business is in a hole and management will be held accountable for that outcome. There may be reluctance to engage someone, but the business will not only be advantaged by fresh eyes but will benefit from having an independent person between the company and its creditors.

Businesses fail every day. The important point though is whether or not all reasonable chances of recovery were considered. Voluntary Administration is the legal regime designed specifically to see whether or not the business can continue in existence. Its implementation is intended to be an alternative to liquidation. There will be latent consequences though. One of the ways the government responded to the pandemic was by providing business subsidies to offset the economic impact of being in lockdown.

There will be latent consequences though. One of the ways the government responded to the pandemic was by providing business subsidies to offset the economic impact of being in lockdown.

These subsidies were necessary to preserve the form and structure of business during the time that it could not fulfil its primary purpose – to trade.

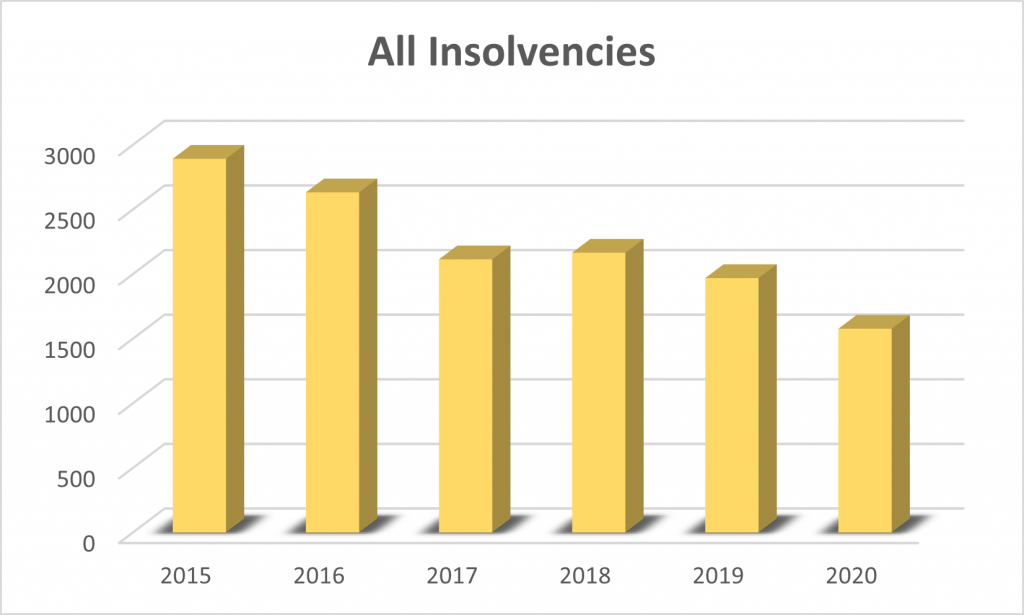

The problem though is that subsidies produce inefficiencies and allow companies that are not viable to continue to trade as well as to potentially have other companies. In normal situations the market economy rewards businesses that produce goods or services profitably and sacrifices companies that cannot. This natural selection process is avoided when subsidies are available.As the graph above shows – in calendar year 2020, formal states of insolvency were just 80% of 2019. When considered against earlier years this is a statistical anomaly and likely to result in a flurry of insolvencies when subsidies end. The same trend has been reported in both Australia and America.

There is much discussion currently about the next wave of insolvencies and the impact it will have on the broader economy. In my view, companies that have survived because subsidies have hidden pre-Covid underlying conditions, will find it very difficult to continue. The companies that were viable pre-Covid but have been impacted by demand shifts will either adapt or elect to stop trading before insolvency hits. The tourism sector is an example of this.

Where have the insolvencies come from?

Not surprisingly, the largest volume of insolvencies for 2020 happened in Auckland. The volume might be slightly disproportionate to the national population because Auckland businesspeople may be slightly less risk averse.

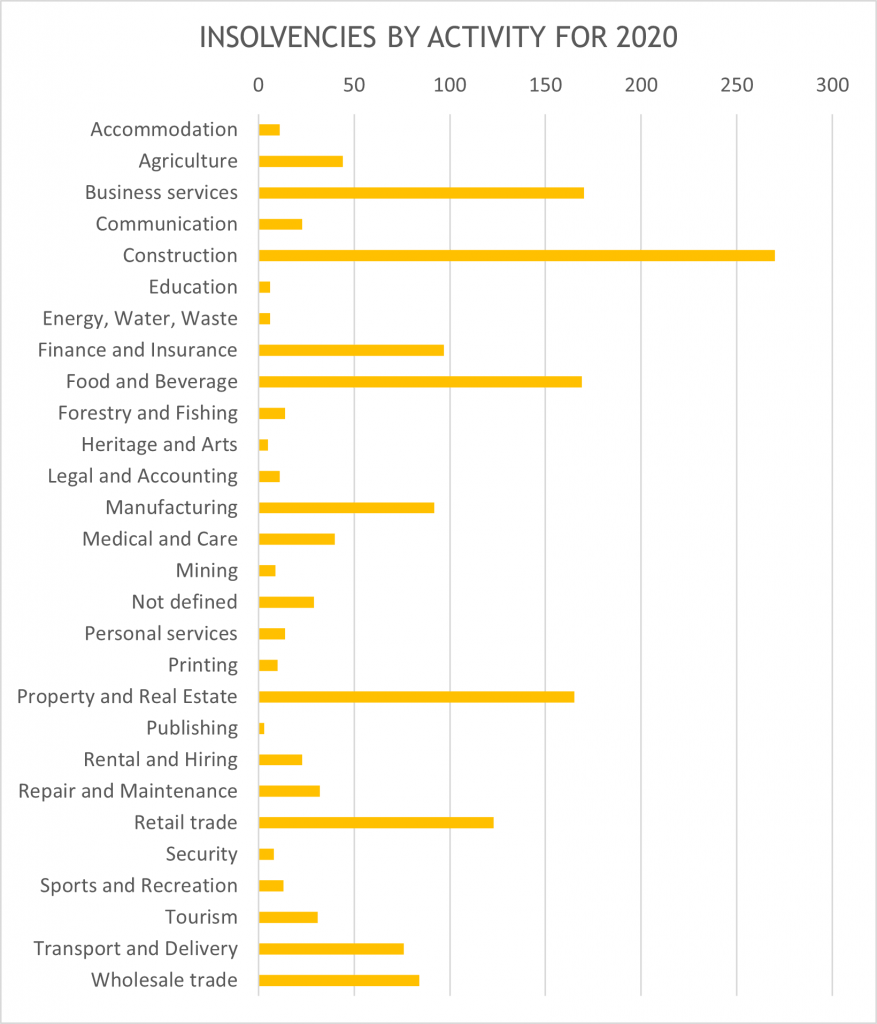

The table to the right shows the types of businesses that experienced insolvency in 2020. Construction is the leader with three sectors – business services, food and beverage, and property and real estate – coming in second.

Surprisingly, tourism has not featured as strongly as might be expected, given the lockdown and border restrictions.

It is likely that many of New Zealand’s tourist businesses were viable and solvent before Covid-19, and when border restrictions occurred the businesses either realigned their delivery to a new demand or ceased to trade.

Voluntary Administration can alter the course of insolvency

For many, insolvency is likely to be a once-in-a-lifetime experience. Events surrounding insolvency can be harsh and at times overwhelming. Creditors that the company has previously dealt with – in some instances for many years – suddenly find license to express their views about the company’s financial affairs in a direct manner and often without filter.

The appointment of an administrator – the first step of the Voluntary Administration process – brings much-needed independence and objectivity to the situation. A competent administrator is key to facilitating good discussions and guiding the parties towards solutions for the issues at hand.

Appointing an administrator stops the grab-and-run mindset that is so often a part of liquidations and lays out a path for creditors to express their views and consider the options available. No one party is entitled to act in a wholly self-interest way during this process. All the affected parties will be required to consider their options in the context of what is best for the company – or to abort and vote in support of liquidation.

There is no easy route in insolvency. Creditors will suddenly become aware that their claim in the company may not be as valuable as first thought. At the same time, shareholders will need to reconcile themselves to the reality that their time and capital may well be lost.

Regardless of the outcome, it makes sense to have breathing space between the time that help is required and the time that the final decision is made about the business’s future. Voluntary Administration can provide this.