Receiving a statutory demand can be a critical moment for any business owner. In this six-part Statutory Demand series, we’ll guide you through the process – from understanding your immediate obligations to potential pathways towards liquidation or rehabilitation. Our aim is to help company directors make informed decisions during this challenging period while understanding both their rights and obligations.

Part 1: The arrival of a Statutory Demand

Does the service of a Statutory Demand mean liquidation?

The arrival of a statutory demand on your company doorstep is like receiving a body blow, often coming at a time when you are giving endless hours to try and make ends meet. It can be enough to tip the scales of your resolve.

Often a statutory demand is the first step to be taken by the creditor. It gives the impression that the creditors’ patience has come to an end and that liquidation is the intended next step.

Regardless of the basis for the action and the emotional consequences it may bring, the unavoidable fact is that the need for action is paramount. There is no sense in ignoring the demand or deferring it to another day. The statutory demand has forced the need for swift action by the company, which must respond to the situation.

What is a Statutory Demand?

A Statutory Demand is a demand for payment that is supported by a legal framework and has serious consequences if settlement is not achieved. The purpose of a Statutory Demand is to provide creditors with a way to initiate the necessary action to recover outstanding debts.

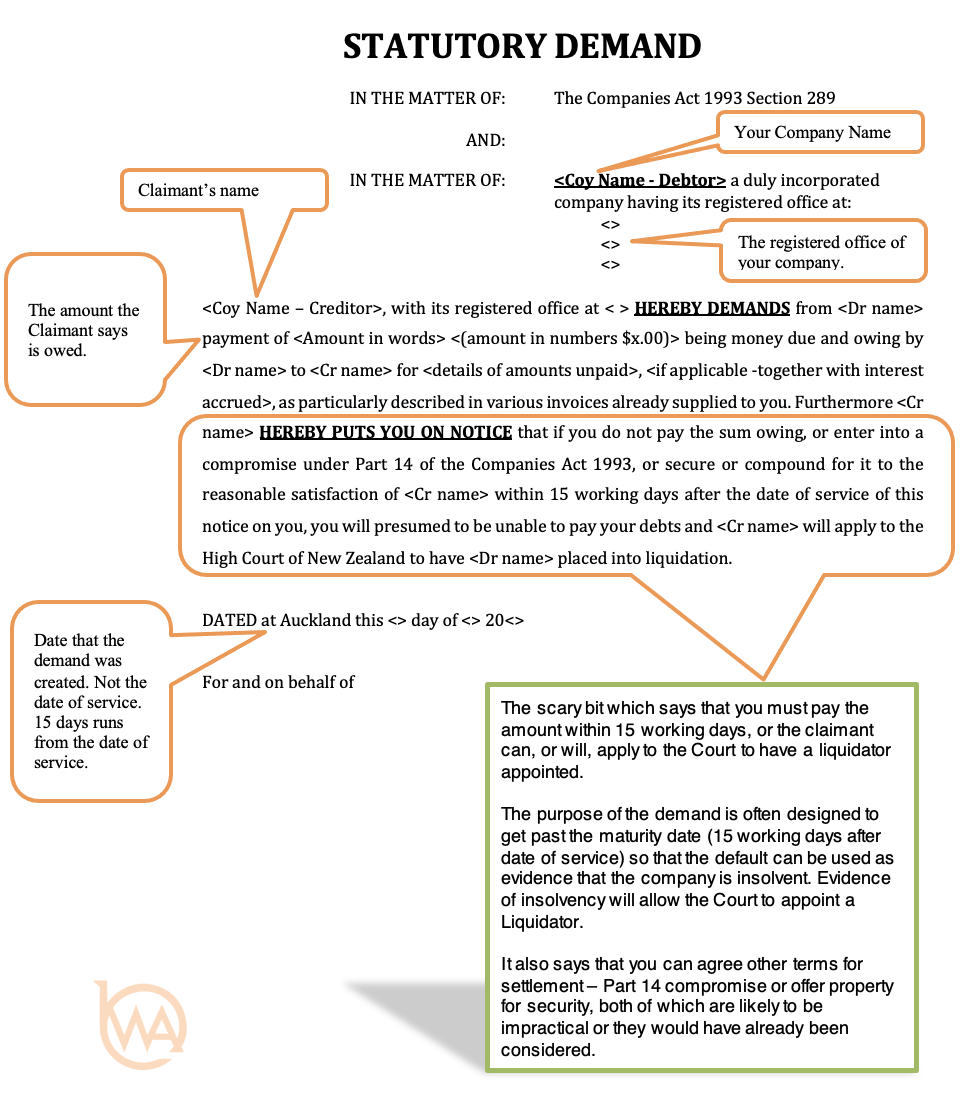

A typical statutory demand document is shown below. Although it appears ominous with its time schedule and legal phrases, it is nothing more than a demand to pay the issuer.

While it is likely that you are already aware of this debt, what’s scary is the legal requirement to pay within 15 working days.

The difference between a Statutory Demand and other documents, like a monthly statement showing an unpaid balance, is that if the amount is not paid by the date prescribed, the default can be used as evidence that the company is insolvent.

From the creditor’s perspective, the idea behind serving the demand is to achieve payment for the amount owing. Or, if there is no payment, then the continued default can be used in support of an application to the Court to appoint a liquidator. Note that if there is a genuine dispute over the demanded amount then an application must be made within 10 days from the date of service to have the demand set aside. Disputing a Statutory Demand will be the subject of a blog to follow.

What to do if a statutory demand is served

The first thing to do is record the time and date that the demand was served at the registered office of the company. Write that detail on the face of the document.

The second thing to do is to recognise that the company could very well be insolvent. It may be time to address the fact that tough times have caused the current circumstances and things may get tougher unless action is taken.

You have some time but there isn’t any time to waste. It is important that you seek advice immediately to ensure you are informed and making the best decisions for your circumstances. Timely and expert advice is crucial to avoid a delayed or incorrect response, which could further jeopardise the outcome.

When speaking with an insolvency practitioner, topics that should be addressed, include:

- the degree of insolvency

- the viability of the company

- the company’s prospects

- the company’s current liquidity,

- the value of the demands being made on the people keeping the company afloat – both in time capital and economic capital.

The important thing to do is to take the time to find out what options exist for the company and to consider how those options work within the current circumstances. This will not be hard to do. BWA Insolvency has a policy of providing critical information free of charge so that an informed decision can be made.

Read Part II: The purpose of a Statutory Demand

If you would like to discuss your options, contact Bryan today for a confidential, no-obligation chat.