Year In Review 2023

The big picture

2020 was a memorable year for many reasons to people in business. The impact of Covid-19 is certain to be at the top of the list.

Attempts to beat the virus prevented the most fundamental requirement of commerce – people selling to people. Here in New Zealand, our elected officials contended that defeating the virus and preserving the economy were achieved with the same strategy – go hard and go early. Of course, it makes sense that economic confidence will be restored when what caused it – demand turned off by the lockdown – is turned back on again. It is hard to argue against the strategy adopted, and government have been applauded internationally because of it.

There will be latent consequences though. One of the ways the government responded to the pandemic was by providing business subsidies to offset the economic impact of being in lockdown.

There will be latent consequences though. One of the ways the government responded to the pandemic was by providing business subsidies to offset the economic impact of being in lockdown.

These subsidies were necessary to preserve the form and structure of business during the time that it could not fulfil its primary purpose – to trade.

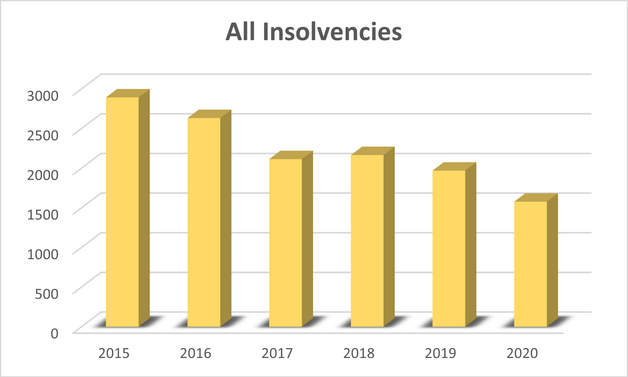

The problem though is that subsidies produce inefficiencies and allow companies that are not viable to continue to trade as well as to potentially have other companies. In normal situations the market economy rewards businesses that produce goods or services profitably and sacrifices companies that cannot. This natural selection process is avoided when subsidies are available.As the graph above shows – in calendar year 2020, formal states of insolvency were just 80% of 2019. When considered against earlier years this is a statistical anomaly and likely to result in a flurry of insolvencies when subsidies end. The same trend has been reported in both Australia and America.

There is much discussion currently about the next wave of insolvencies and the impact it will have on the broader economy. In my view, companies that have survived because subsidies have hidden pre-Covid underlying conditions, will find it very difficult to continue. The companies that were viable pre-Covid but have been impacted by demand shifts will either adapt or elect to stop trading before insolvency hits. The tourism sector is an example of this.

Where have the insolvencies come from?

Not surprisingly, the largest volume of insolvencies for 2020 happened in Auckland. The volume might be slightly disproportionate to the national population because Auckland businesspeople may be slightly less risk averse.

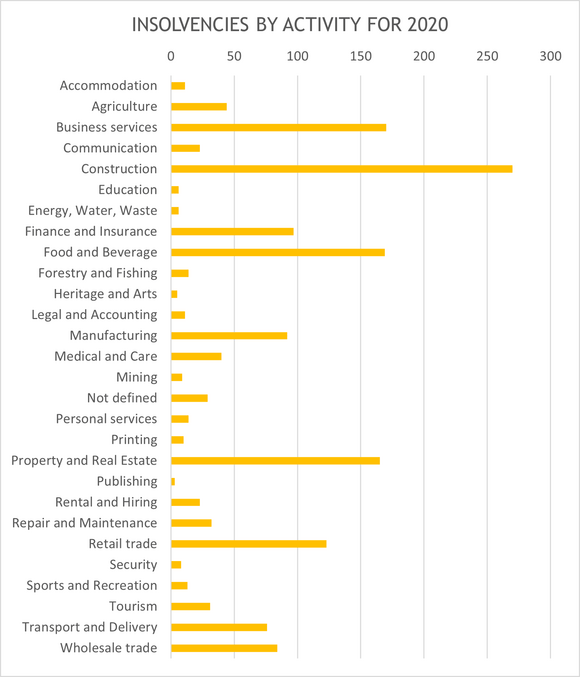

The table to the right shows the types of businesses that experienced insolvency in 2020. Construction is the leader with three sectors – business services, food and beverage, and property and real estate – coming in second.

Surprisingly, tourism has not featured as strongly as might be expected, given the lockdown and border restrictions.

It is likely that many of New Zealand’s tourist businesses were viable and solvent before Covid-19, and when border restrictions occurred the businesses either realigned their delivery to a new demand or ceased to trade.

Voluntary Administration can alter the course of insolvency

For many, insolvency is likely to be a once-in-a-lifetime experience. Events surrounding insolvency can be harsh and at times overwhelming. Creditors that the company has previously dealt with – in some instances for many years – suddenly find license to express their views about the company’s financial affairs in a direct manner and often without filter.

The appointment of an administrator – the first step of the Voluntary Administration process – brings much-needed independence and objectivity to the situation. A competent administrator is key to facilitating good discussions and guiding the parties towards solutions for the issues at hand.

Appointing an administrator stops the grab-and-run mindset that is so often a part of liquidations and lays out a path for creditors to express their views and consider the options available. No one party is entitled to act in a wholly self-interest way during this process. All the affected parties will be required to consider their options in the context of what is best for the company – or to abort and vote in support of liquidation.

There is no easy route in insolvency. Creditors will suddenly become aware that their claim in the company may not be as valuable as first thought. At the same time, shareholders will need to reconcile themselves to the reality that their time and capital may well be lost.

Regardless of the outcome, it makes sense to have breathing space between the time that help is required and the time that the final decision is made about the business’s future. Voluntary Administration can provide this.